When people first step into Bitcoin mining, the first thing they ask is, “What’s the best machine I can buy?” It’s a fair question. After all, hardware is the most visible part of mining, the big, humming rigs that crank out bitcoin rewards.

But here’s the truth: the machine isn’t what makes or breaks your mining business. The price of your power does.

At Abundant Mines, this is one of the first lessons we share with investors. Hardware is important, but without cheap, reliable energy, even the newest and shiniest machines will struggle to stay profitable. Let’s unpack why.

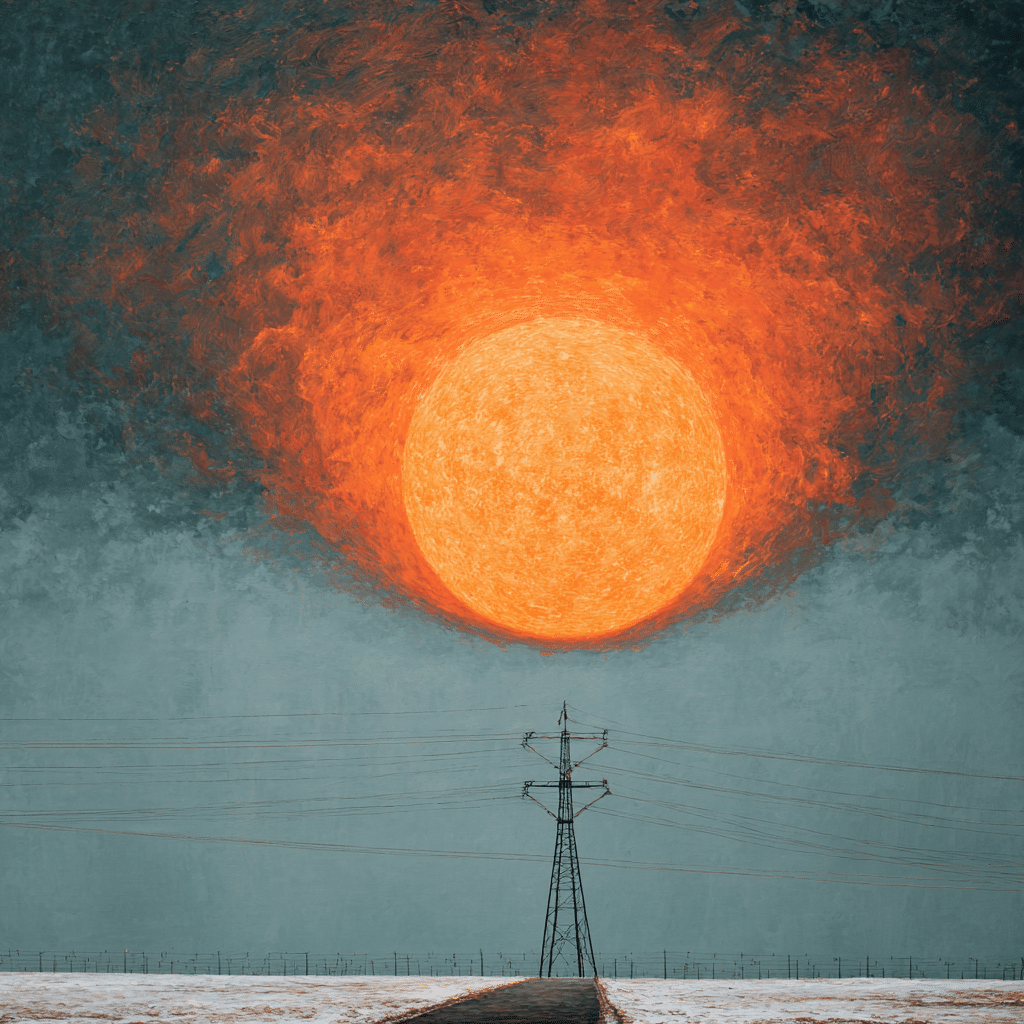

The Real Fuel of Mining

Think of a mining machine like a high-performance car. Yes, the engine matters. But what really determines how far you can go is the cost of fuel.

In bitcoin mining, energy is that fuel. Your machines are simply converting electricity into bitcoin. The cheaper your electricity, the more bitcoin you get to keep.

Why Chasing Hardware Alone Doesn’t Work

Mining manufacturers release new models every year. They promise more efficiency, more hashrate, and sometimes they deliver. But if you’re paying top-dollar for power, those gains can vanish overnight.

Hardware is always changing. Power is the constant, and power costs stack up every single hour your machines are running. That’s why energy is the real driver of returns.

Renewables: The Edge Most Don’t See Coming

Here’s where things get exciting. Not only does cheap power protect your bottom line, it can also be cleaner.

At Abundant Mines, our site is tied to renewable and hydroelectric sources. These energy contracts aren’t just environmentally responsible, they’re cost-competitive. Hydropower, in particular, gives us stable, affordable electricity that allows investors to ride out market cycles and stay profitable longer.

Cheap, renewable power means your miners don’t just survive the bear markets, they thrive in them.

Why Energy > Hardware for Investors

For high-net-worth investors, this is the real takeaway:

- You don’t need to chase the latest machine release.

- You need to secure the right hosting partner with the right power contracts.

The best miner in the wrong location will bleed money. A solid miner in the right location with cheap, renewable power will quietly stack bitcoin for years.

That’s the compounding effect energy delivers.

Our Philosophy at Abundant Mines

We don’t sell hype. Our philosophy is simple: power first, hardware second.

By focusing on long-term energy deals, especially renewables, we ensure that every machine we deploy has a fighting chance to stay profitable through the ups and downs of Bitcoin’s price cycles.

From grid to wallet, it all starts with the cost of your power.

📞 Ready to Mine Smarter?

If you’re looking to invest in mining, start with energy not hardware.

👉 Book a call with Abundant Mines to see how our renewable and hydroelectric hosting keeps machines running profitably while you accumulate more Bitcoin.

Disclaimer: The information provided in this blog is for informational and educational purposes only and should not be construed as financial advice. Please consult with a financial advisor or conduct your own research before making any financial decisions.