It’s the first question on everyone’s mind, even if they’re afraid to ask it: Is bitcoin mining a scam?

With the digital world full of get-rich-quick schemes and complex financial products, a healthy dose of skepticism isn’t just wise, it’s necessary. You’ve heard stories of people losing money, of companies disappearing overnight, and of promises that sound too good to be true. So, when you hear about an opportunity to “mine” a digital currency, it’s natural to be cautious.

In this article, we’re going to address this question head-on. No hype, no jargon, just a transparent look at the real risks and rewards of bitcoin mining. We’ll explore why the industry has a reputation for being risky, how to spot a legitimate opportunity, and what you should look for in a trusted partner.

Why Bitcoin Mining Can Feel Like a Scam

1. Intangibility: Unlike real estate or stocks, you can’t physically touch bitcoin or the mining process. It’s all digital, which can feel abstract and less “real” than traditional investments. As one of our customers, Jeff, put it before he started, “I didn’t really know enough about it to make an educated decision.” This lack of familiarity can breed distrust.

2. Complexity: The technical side of bitcoin mining can be overwhelming. Hashrates, ASICs, mining pools, difficulty adjustments… it’s a lot to take in. This complexity can create a knowledge gap that makes it hard to tell the difference between a real opportunity and a fraudulent one.

3. Bad Actors: Let’s be honest, the digital currency space has had its share of scams. From cloud mining companies that don’t actually own any miners to Ponzi schemes dressed up as investment platforms, bad actors have taken advantage of the complexity and hype to defraud investors. This has, unfortunately, cast a shadow over the entire industry.

4. Volatility: The price of bitcoin is famously volatile. This can make it difficult to predict returns and can lead to situations where the cost of mining is higher than the value of the bitcoin being mined. This economic uncertainty can feel like a risk that’s not worth taking.

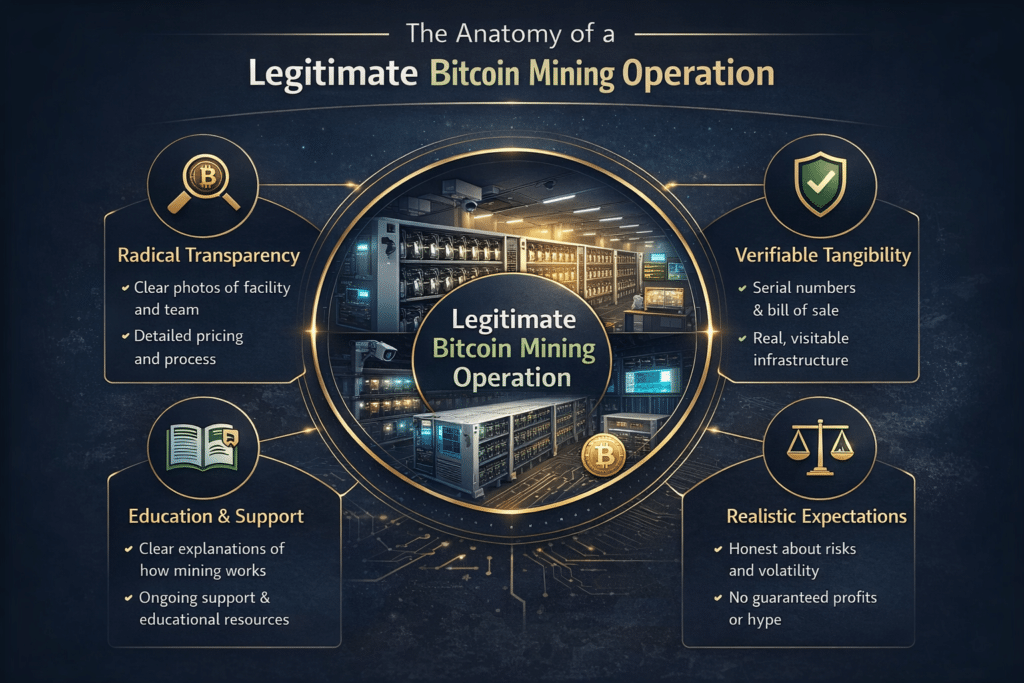

How to Tell the Difference: The Anatomy of a Legitimate Mining Operation

So, how do you separate the scams from the real opportunities? It comes down to a few key principles that any legitimate bitcoin mining operation should embody:

1. Radical Transparency

A legitimate operation has nothing to hide. They should be open and transparent about:

- Their facility: Where are the miners located? Can you visit? Do they have photos and videos of their operations? Placeholder for facility photo

- Their team: Who are the people behind the company? Do they have real-world experience? Are they accessible? Placeholder for team photo

- Their pricing: Are the costs clear and upfront? A legitimate provider will give you a clear breakdown of hardware costs, monthly hosting fees (which include electricity, cooling, and maintenance), and any setup fees. There should be no surprises.

- Their process: How does it all work? They should be able to explain it in simple, easy-to-understand terms.

As our customer Jeff said, “The biggest concerns were trust factor and transparency. I wanted to be able to do business with somebody that was tangible and showed that transparency.”

2. Verifiable Tangibility

Even though bitcoin is digital, the mining process is very physical. It involves real computers (ASICs) in a real building, consuming real electricity. A legitimate operation should be able to make this tangible for you:

- You own the miners: In a legitimate hosted mining setup, you purchase and own the physical miners. You should receive a bill of sale with the serial numbers of your specific machines, proving your ownership.

- You can see the facility: You should be able to visit the facility where your miners are hosted. If a company is cagey about their location, that’s a major red flag.

- You have a direct connection: You should have a direct line of communication with the team. As another customer, Steve, said, “I like the fact that they’re local to me… I would not like to be sending my money to a different state or different country for this.”

Placeholder for diagram comparing a scam vs. legitimate operation

3. A Commitment to Education

A legitimate partner wants you to be educated. They’re not trying to take advantage of your lack of knowledge. They should provide:

- Clear explanations: They should be able to explain how mining works without using confusing jargon.

- Ongoing support: They should be there to answer your questions before, during, and after you start mining.

- Educational resources: They should provide articles, videos, and guides to help you understand the process and the market.

As Jeff put it, “It was not just a ‘Hey, I got your money and here’s your thing, and we’ll talk later.’ There was a next step always, which was great.”

4. Realistic Expectations

A legitimate operation will not promise you guaranteed returns or get-rich-quick results. They will be honest about the risks, including:

- Price volatility: The price of bitcoin can go up or down, which will affect your profitability.

- Difficulty adjustments: The bitcoin network adjusts its difficulty every two weeks, which can impact your mining rewards.

- Hardware depreciation: Mining hardware becomes less competitive over time and will eventually need to be replaced.

They should help you understand these risks and how to manage them, not pretend they don’t exist.

What About the Worst-Case Scenario?

This is a fair question. What if the price of bitcoin goes to zero? While we believe this is highly unlikely given bitcoin’s growing adoption and network security, it is a risk to consider with any investment. In this scenario, the value of your mined bitcoin would also go to zero, and your mining hardware would have little resale value.

However, our business model is designed to help you weather volatility. By sourcing low-cost energy and running efficient operations, we aim to keep your cost of production as low as possible. This means that even in a bear market, you can continue to accumulate bitcoin at a low cost, positioning you for significant upside when the market recovers. We believe in the long-term value of bitcoin, and we’re structured to help our customers stay in the game for the long haul.

The Abundant Mines Approach: Trust Through Transparency

At Abundant Mines, we built our entire business around these principles because we believe that trust is the most important asset in this industry.

Here’s how we address the common concerns:

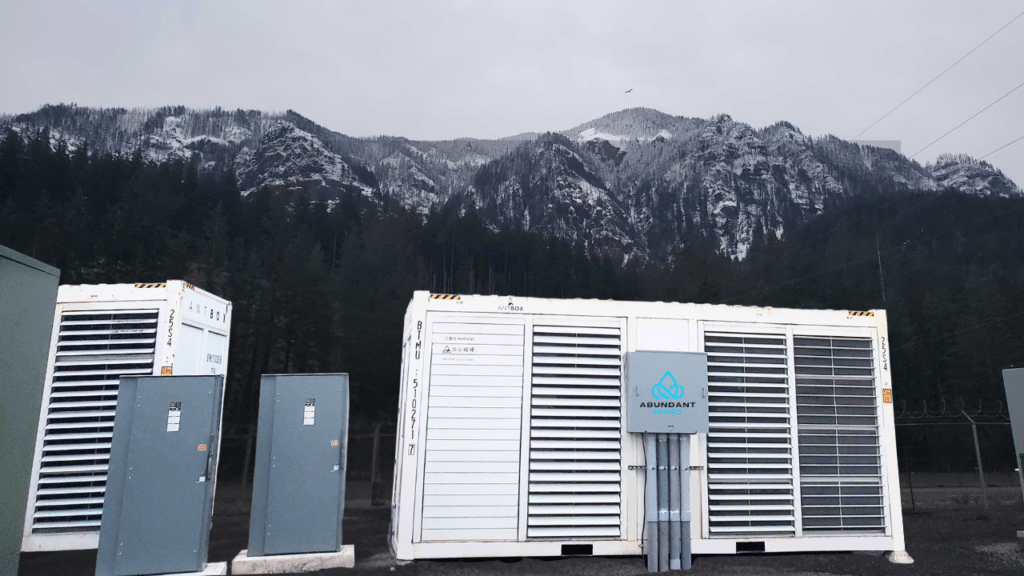

- We’re Local and Tangible: Our facility is located in the beautiful Columbia River Gorge in Oregon. We’re a local business, and we invite our customers to come and visit. You can see your miners, meet our team, and know that you’re working with real people in a real place.

- We’re Radically Transparent: We believe in open and honest communication. We provide clear, upfront pricing, detailed performance reporting, and direct access to our team. We want you to feel comfortable asking any question, any time.

- We’re Educators First: We want you to be an educated miner. That’s why we provide a wealth of educational resources, host regular meetups, and take the time to explain everything in simple, easy-to-understand terms. Our goal is to empower you, not to confuse you.

- We’re Your Long-Term Partner: We’re not interested in a quick sale. We’re interested in building a long-term partnership with you. We’ll help you navigate the market, manage your miner portfolio, and make informed decisions for years to come.

The Bottom Line: Is It a Scam?

Bitcoin mining itself is not a scam. It’s a legitimate and essential part of the bitcoin network. However, there are scams within the mining industry, just as there are in any other financial industry.

The key is to do your due diligence and partner with a company that is transparent, tangible, educational, and realistic.

If a company is promising you guaranteed returns, is vague about their operations, or pressures you to invest before you’re ready, walk away. But if you find a partner who is willing to answer your questions, show you their facility, and educate you on the risks and rewards, you may have found a legitimate opportunity to participate in the future of money.

Ready to take the next step?

Watch a Video Tour of Our Facility to see exactly how it works.

Schedule a No-Obligation Call with Our Team to get your specific questions answered.

Download Our Free Guide: 36 Point Guide to View Before Investing in Bitcoin Mining to arm yourself with the right questions.