When bitcoin’s price falls, it’s natural to feel a sense of uncertainty. Headlines often paint a grim picture, and for those new to the space, a bear market can feel like the end of the road. But for bitcoin miners, a market downturn isn’t a crisis; it’s a crucial part of the cycle. It’s a period of cleansing, consolidation, and ultimately, opportunity.

In this article, we’ll pull back the curtain on what really happens to bitcoin mining during a bear market. We’ll explore the economic forces at play, the built-in mechanisms that keep the network running, and why efficient miners not only survive but emerge stronger.

The Counterintuitive Truth About Bear Markets

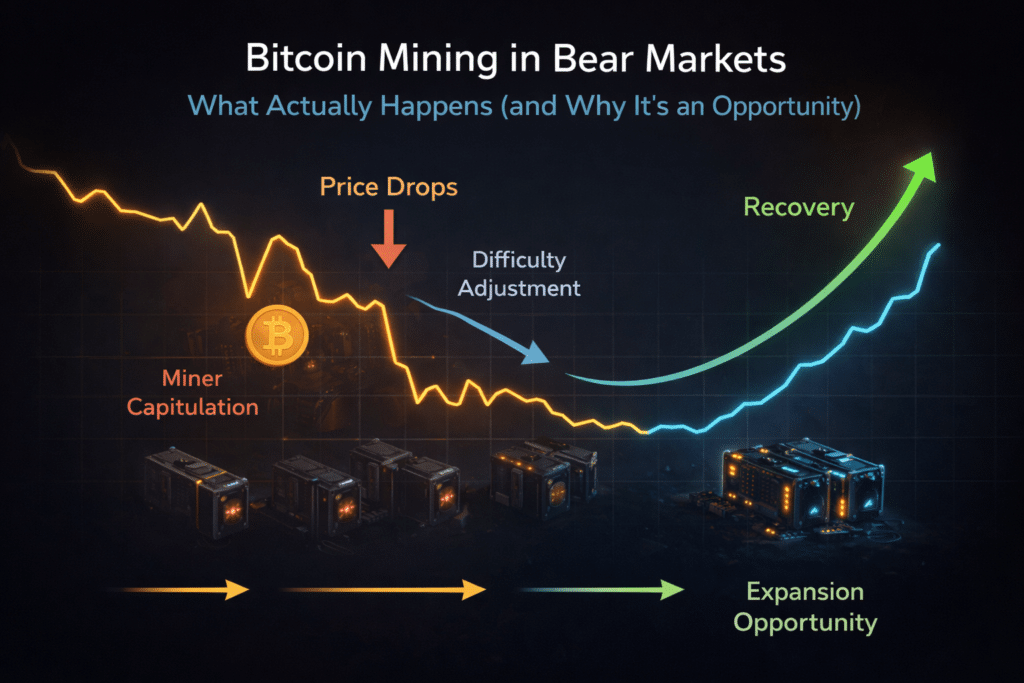

It may seem counterintuitive, but a bear market is a healthy and necessary part of the bitcoin ecosystem. It’s a stress test that weeds out inefficient operations and rewards those with a long-term vision. Here’s what happens when the price drops:

1. Inefficient Miners Capitulate

When the price of bitcoin falls below a miner’s cost of production, they are forced to shut down their machines. This is known as miner capitulation. These are typically operators with older, less efficient hardware, higher electricity costs, or a short-term, speculative mindset. They can no longer afford to mine at a loss, so they unplug.

During the 2022 bear market, this was a widespread phenomenon. With bitcoin’s price falling 65% and energy costs soaring, many miners were forced to sell their equipment at a steep discount just to stay afloat [1].

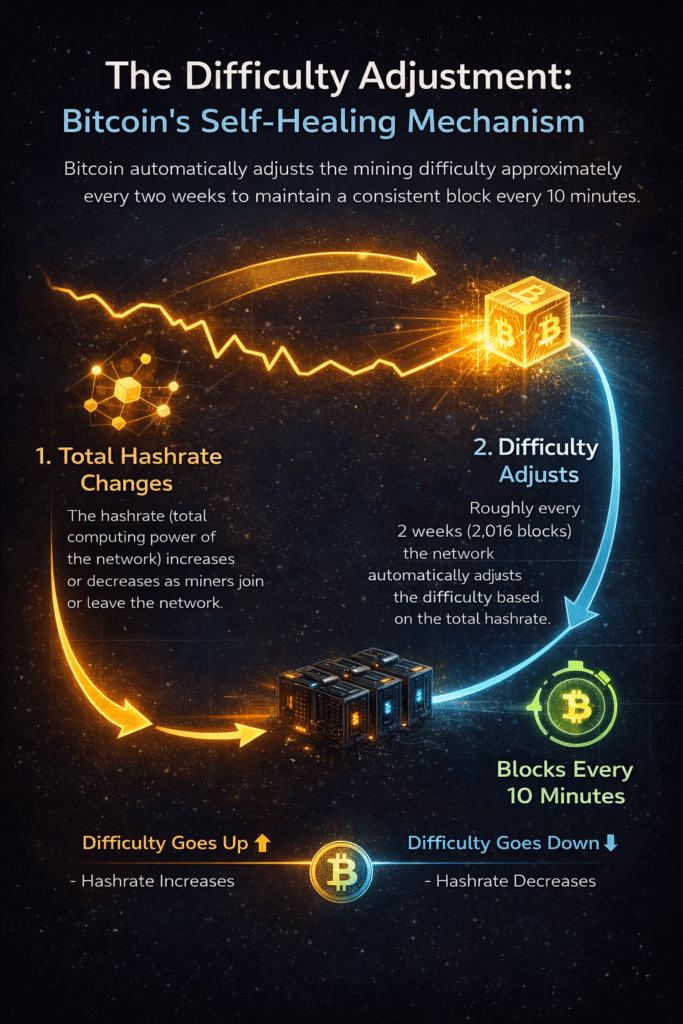

2. The Difficulty Adjustment: Bitcoin’s Self-Healing Mechanism

This is where bitcoin’s genius design comes into play. The network is programmed to automatically adjust the mining difficulty every 2,016 blocks (approximately every two weeks). When miners leave the network, the total hashrate (the network’s combined computing power) decreases. The difficulty adjustment responds by lowering the difficulty, making it easier for the remaining miners to find the next block [2].

This is a powerful, self-correcting mechanism. As the difficulty drops, mining becomes more profitable for the efficient miners who are still operating. This ensures that blocks continue to be produced at a steady rate (approximately every 10 minutes) and that the network remains secure.

In February 2026, we saw this in action when the mining difficulty dropped by over 11%, the largest negative adjustment since the 2021 China mining ban [3]. This was a direct response to miner capitulation and a clear signal that the network was rebalancing itself.

3. A Buyer’s Market for Efficient Miners

For efficient miners with low operating costs, a bear market is a golden opportunity. As inefficient miners sell off their hardware at fire-sale prices, efficient operators can expand their fleets at a fraction of the cost. This allows them to increase their market share and position themselves for even greater profitability when the next bull market arrives.

As one industry expert noted, “Those who know how the equipment works and understand the cyclical nature of Bitcoin are always in the black. And they are not afraid of any bear market” [4].

The Economics of Survival: Who Wins and Who Loses?

Not all miners are created equal. Survival in a bear market comes down to one thing: efficiency. Here’s a breakdown of the winners and losers:

| Miner Profile | Characteristics | Bear Market Outcome |

|---|---|---|

| The Inefficient Operator | Older hardware, high electricity costs, speculative mindset | Capitulates. Forced to shut down and sell equipment at a loss. |

| The Efficient Operator | Latest-generation hardware, low-cost power, long-term vision | Thrives. Continues to mine profitably, expands operations by acquiring cheap hardware. |

| The Hosted Miner | Predictable costs, professional management, access to economies of scale | Resilient. Benefits from stable, all-inclusive pricing and expert operational management, weathering the storm more effectively. |

At Abundant Mines, our clients fall into the hosted miner category. With our fixed-rate, low-cost hydroelectric power and professional on-site maintenance, our clients can continue to operate profitably even when the market is down. We handle the operational complexities so you can focus on the long-term opportunity.

The Production Cost Floor: A Natural Price Support

There’s a natural floor to how low the price of bitcoin can go. When the price falls below the average cost of production, it becomes unprofitable for a significant portion of the network to continue mining. When the market price of bitcoin is lower than the average cost of production, it creates an incentive for miners to actually take the operating capital used to mine coins and actually purchase them on the open market instead, creating a natural support for price through open market purchases.

According to a February 2026 report from CoinShares, the average production cost for publicly traded miners was around $74,600. The report noted that when bitcoin’s price falls below this level, the situation is typically “short-lived” [5]. This is because the economics become unsustainable, forcing a market correction through the difficulty adjustment from miners falling off the network, by the price support that comes from miners entering the market as spot buyers, or both.

Conclusion: A Time for Opportunity, Not Panic

A bear market isn’t a reason to panic. It’s a predictable and healthy part of bitcoin’s economic cycle. It’s a time when the network purges inefficiency and rewards those with a long-term perspective.

For savvy investors, a bear market is an opportunity to enter the mining space at a lower cost, acquire hardware at a discount, and position themselves for the next wave of growth. By understanding the mechanics of the difficulty adjustment and the economics of production, you can see why a downturn is not the end, but a new beginning.

Ready to learn more about how you can benefit from bitcoin mining, in any market?

Schedule a consultation with our team today.

References

[1] Hashrate Index. (2023, January 13). 2022: The Toughest Year Ever for Public Bitcoin Miners. Retrieved from https://hashrateindex.com/blog/bitcoin-might-be-in-a-bear/

[2] Lightspark. (2025, July 17). The Purpose and Power of Bitcoin’s Difficulty Adjustment. Retrieved from https://lightspark.com/glossary/difficulty-adjustment

[3] CoinDesk. (2026, February 9). Bitcoin mining difficulty drops by most since 2021 as miners capitulate. Retrieved from https://www.coindesk.com/markets/2026/02/09/bitcoin-mining-difficulty-drops-by-most-since-2021-as-miners-capitulate

[4] BDC Consulting. (2024, February). How Miners Survived the Crypto Winter. Retrieved from https://bdc.consulting/blog/opinion/how-miners-survived-the-crypto-winter

[5] ETF Trends. (2026, February 10). Bitcoin Mining Economics Signal Potential Market Floor. Retrieved from https://www.etftrends.com/coinshares-content-hub/bitcoin-mining-economics-signal-potential-market-floor/