If you’re reading this, you’ve probably heard of bitcoin. Maybe a friend mentioned it at dinner, or you saw a headline about its price hitting a new high. But when you try to explain it to someone else, or even to yourself, the words get a little fuzzy.

“It’s digital money.” “It’s like gold, but on the internet.” “It’s a new kind of currency.”

All of these are partially true, but they don’t quite capture the full picture. And that’s okay. Bitcoin is a genuinely new concept, and it takes time to wrap your head around it.

In this article, we’re going to break down exactly what bitcoin is, how it works, and most importantly, what it is not. No jargon, no hype, just a clear, straightforward explanation.

What is Bitcoin? The Simple Answer

At its core, bitcoin is a decentralized, digital store of value.

Let’s unpack that definition:

Decentralized: No single person, company, or government controls it. Bitcoin is run by a global network of thousands of computers (called nodes) that work together to maintain the system. There’s no CEO of bitcoin, no headquarters, and no central authority that can shut it down or manipulate it.

Digital: Bitcoin only exists in digital form. There are no physical bitcoins you can hold in your hand. It’s all software, code, and cryptography. But just because it’s digital doesn’t mean it’s not real. Your bank account is digital too, and you trust that the numbers on your screen represent real value.

Store of Value: This is the most important part. Bitcoin is designed to preserve your wealth over time, similar to how gold has been used for thousands of years. It’s not primarily designed to buy your morning coffee (though you can). It’s designed to be a long-term savings technology that protects your purchasing power from inflation and devaluation.

Think of bitcoin as digital gold. It’s scarce (there will only ever be 21 million bitcoin), it’s durable (the network has been running 24/7 since 2009 without a single day of downtime), and it’s portable (you can send it anywhere in the world in minutes).

How Does Bitcoin Work? The Basics

Bitcoin runs on something called a blockchain. If you’ve heard that term before and your eyes glazed over, don’t worry. It’s simpler than it sounds.

A blockchain is just a digital ledger that records every bitcoin transaction that has ever happened. Think of it like a giant spreadsheet that everyone can see, but no one can cheat or change.

Here’s the simplified version of how it works:

- Someone sends bitcoin: Alice wants to send 1 bitcoin to Bob. She creates a transaction using her bitcoin wallet.

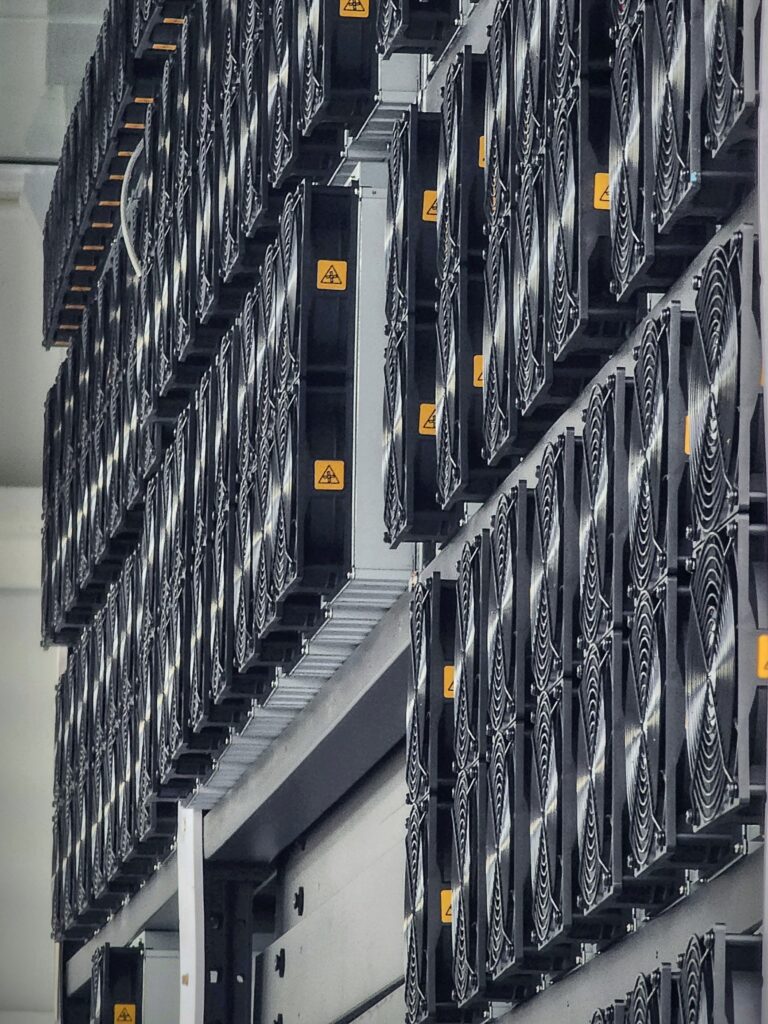

- The network verifies it: The transaction is broadcast to thousands of computers around the world (called miners) who verify that Alice actually has 1 bitcoin to send.

- It’s added to the permanent record: Once verified, the transaction is grouped with others into a “block” and added to the blockchain. This happens about every 10 minutes.

This entire process is secured by an enormous amount of computing power, making it virtually impossible to cheat or reverse transactions. The result is a system where you can send value to anyone, anywhere in the world, without needing a bank, a payment processor, or any middleman.

Want to understand how this verification process works? Read our guide on How Bitcoin Mining Works to learn about the “global lottery” that secures the network.

What Bitcoin is NOT

Now that we’ve covered what bitcoin is, let’s clear up some common misconceptions:

It’s NOT Anonymous

One of the biggest myths about bitcoin is that it’s completely anonymous and only used by criminals. This is false.

Every bitcoin transaction is recorded on the public blockchain. Anyone can see the transaction history of any bitcoin address. While your name isn’t directly attached to your bitcoin address, if someone can connect you to that address (through an exchange, for example), they can see your entire transaction history.

In fact, bitcoin is often described as “pseudonymous” rather than anonymous. It’s more private than using a credit card, but it’s not invisible. Law enforcement agencies have successfully tracked criminals using bitcoin precisely because of this public ledger.

It’s NOT Just for Criminals

Yes, like any form of money, bitcoin has been used for illegal activities, but because of the points mentioned above, it is not ideal at all for crime. The vast majority of bitcoin users are ordinary people, businesses, and institutions using it for legitimate purposes.

Today, bitcoin is held by:

- Fortune 500 companies like Tesla and Strategy

- Publicly traded investment funds like Blackrock Grayscale and Fidelity

- Millions of individual investors around the world

- Entire countries (El Salvador made bitcoin legal tender in 2021, Bhutan has been mining since 2017)

The idea that bitcoin is primarily used for crime is outdated and simply not supported by the data. A 2023 report by Chainalysis found that illicit activity accounted for less than 1% of all bitcoin transaction volume.

It’s NOT a Get-Rich-Quick Scheme

Bitcoin is not a lottery ticket. It’s not a way to turn $100 into $1 million overnight. While bitcoin has experienced significant price appreciation over its 15+ year history, it has also experienced dramatic crashes and multi-year bear markets.

Bitcoin is a long-term investment in a new kind of financial system. It requires patience, education, and a willingness to weather volatility.

As one of our customers, Jeff, said when he first started learning about mining, “I didn’t really know enough about it to make an educated decision. That’s why I spent time educating myself first.” That’s the right approach.

If someone is promising you guaranteed returns or trying to pressure you into buying bitcoin quickly, walk away. Legitimate bitcoin businesses focus on education and transparency, not hype and pressure.

It’s NOT Going to Replace All Money Tomorrow

Bitcoin is not going to replace the U.S. dollar or eliminate banks next week. That’s not its goal, and it’s not realistic or even ideal.

What bitcoin is doing is providing an alternative. It’s giving people a choice. If you’re concerned about inflation, government overreach, or the stability of the traditional financial system, bitcoin offers a way to store value outside of that system.

Over time, bitcoin may become more widely adopted as a store of value, similar to how gold is used today. But this will be a gradual process, not an overnight revolution.

Why Was Bitcoin Created?

To truly understand bitcoin, it helps to know why it was created in the first place.

Bitcoin was invented in 2008 by an anonymous person (or group) using the pseudonym Satoshi Nakamoto. It was released in January 2009, just a few months after the global financial crisis that nearly collapsed the world economy.

The timing was not a coincidence.

The 2008 crisis exposed the fragility of the traditional financial system. Banks that were “too big to fail” had to be bailed out by taxpayers. People lost their homes, their savings, and their trust in the institutions that were supposed to protect them.

Bitcoin was created as a response to this crisis. It was designed to be a form of money that didn’t require trust in banks, governments, or any central authority. Instead, it relies on mathematics, cryptography, and a decentralized network of computers.

The very first block of the bitcoin blockchain (called the “genesis block”) contains a hidden message: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” This was a reference to a headline from The Times newspaper that day, and it’s widely interpreted as Satoshi’s commentary on the broken financial system.

Bitcoin was created to give people an alternative. A way to store and transfer value that couldn’t be inflated away by governments, frozen by banks, or controlled by any single entity.

Who Uses Bitcoin Today?

Bitcoin has come a long way since 2009. What started as an experiment by a small group of cryptographers and technologists has grown into a global phenomenon.

Today, bitcoin is used by:

Individuals: Millions of people around the world hold bitcoin as a long-term savings vehicle, similar to how previous generations held gold.

Businesses: Companies like Microsoft, Overstock, and PayPal accept bitcoin as payment. Others, like Strategy, hold bitcoin on their corporate balance sheets as a treasury asset.

Investors: Hedge funds, family offices, and institutional investors are allocating a portion of their portfolios to bitcoin as a hedge against inflation and currency devaluation.

Countries: El Salvador became the first country to adopt bitcoin as legal tender in 2021. Other countries are exploring similar moves.

Miners: hundreds of thousands of people and companies around the world are mining bitcoin, securing the network and earning bitcoin as a reward for their work. This is how new bitcoin is created and how the network stays secure.

The profile of the average bitcoin user has changed dramatically. It’s no longer just tech enthusiasts and libertarians. It’s business owners, retirees, financial advisors, and everyday people who are looking for a better way to save for the future.

The Fixed Supply: Why Scarcity Matters

One of the most important features of bitcoin is its fixed supply. There will only ever be 21 million bitcoin. Not 21 million and one. Not 22 million. Exactly 21 million.

This is hardcoded into the bitcoin protocol and cannot be changed without the consensus of the entire network (which is virtually impossible).

Why does this matter?

Because scarcity is what gives something value. Gold is valuable in part because it’s scarce. There’s only so much of it in the earth’s crust, and it’s difficult and expensive to mine.

Traditional currencies, on the other hand, can be printed in unlimited quantities. When governments print more money, the value of each unit of currency goes down. This is called inflation, and it’s why a dollar today buys less than a dollar did 20 years ago.

Bitcoin is designed to be the opposite. Its supply is fixed, which means it cannot be inflated. In fact, bitcoin becomes more scarce over time due to an event called the “halving,” which reduces the rate at which new bitcoin is created every four years.

This scarcity is one of the key reasons why many people view bitcoin as “digital gold” and a hedge against inflation.

Bitcoin vs. Your Bank Account: What’s the Difference?

You might be thinking, “I already have a bank account. Why do I need bitcoin?”

That’s a fair question. Here’s the key difference:

Your bank account is a promise. When you deposit money in a bank, you don’t actually own that money anymore. You own an IOU from the bank. The bank promises to give you your money back when you ask for it. But the bank can freeze your account, limit your withdrawals, or even go bankrupt (as we saw in 2008 and again in 2023 with Silicon Valley Bank).

Bitcoin is property. When you own bitcoin, you actually own it. It’s in your possession (or more accurately, you control the private keys that give you access to it). No one can freeze it, seize it, or prevent you from sending it. It’s yours, completely and unconditionally.

This difference might not seem important if you live in a stable country with a strong banking system. But for billions of people around the world who live under authoritarian governments, suffer from hyperinflation, or don’t have access to basic banking services, this difference is life-changing.

And even in stable countries, the 2008 financial crisis and the 2023 banking failures are reminders that the traditional system is not as safe as we might think.

The Bottom Line: Bitcoin is a New Kind of Money

Bitcoin is not just another payment app or a speculative investment. It’s a fundamentally new kind of money, designed for the digital age.

It’s decentralized, so no single entity controls it. It’s scarce, so it can’t be inflated. It’s digital, so it can be sent anywhere in the world instantly. And it’s transparent, so everyone can verify that the system is working as intended.

Is it perfect? No. It’s still early, it’s still volatile, and it’s still evolving. But for many people, it represents something important: an alternative to the traditional financial system, and a way to take control of their own financial future.

Now that you understand what bitcoin is, the next question is: how do you get it? You have three options: buy it, mine it yourself, or use hosted mining. Each approach has different advantages depending on your goals.

Ready to learn more?

Schedule a Call with Our Team to get your specific questions answered by people who have been in the bitcoin space for over a decade